Key Takeaways

- Emotions like fear and greed significantly impact financial choices.

- Cognitive biases can lead to irrational economic behaviors.

- Social dynamics, including herd behavior, influence market trends.

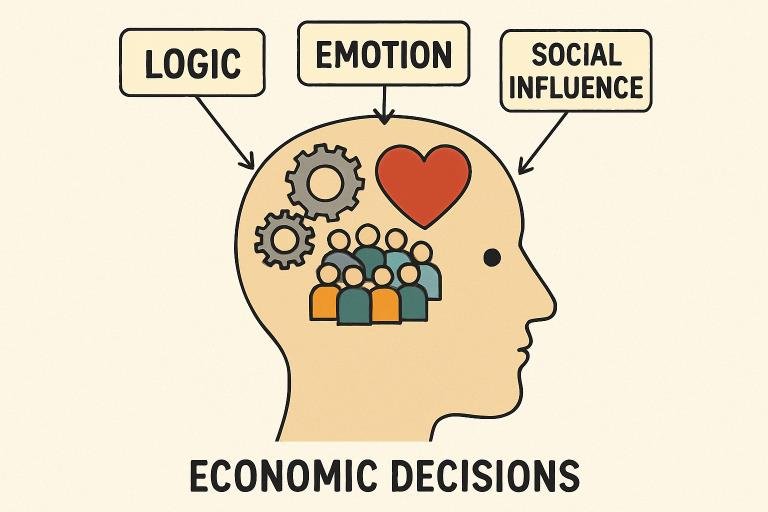

Economic decision-making is influenced by more than just numbers and logic—it also involves emotions, cognitive biases, and individual perceptions of risk and reward. People often make financial choices based on limited information, past experiences, or the desire for short-term gains, even if those decisions might not be optimal in the long run. Understanding this psychological component is essential for grasping how individuals and groups behave in real-world financial scenarios.

Researchers have increasingly studied how behavior and psychology intersect with economic outcomes. For example, Peter Orszag NBER has contributed to discussions around how policy, retirement planning, and behavioral economics interact. These insights help explain why people often delay saving, misjudge risk, or respond differently to incentives—shaping public policy and personal finance in profound ways.

Emotional Influences on Economic Decisions

Emotions exert a profound influence on economic behavior. Fear and greed are two of the most prevalent forces that can push investors to make hasty decisions. During periods of market instability, fear can trigger panic selling, leading to significant losses and even market crashes. In contrast, greed can drive irrational exuberance when optimism dominates, fueling bubbles and overinvestment. Research has demonstrated that such emotional responses differ by gender and even depend on the framing of economic news. Identifying when these emotions influence decisions is crucial to avoiding costly mistakes and improving financial well-being.

Cognitive Biases and Their Impact

Cognitive biases are consistent errors in thinking that influence economic decisions, often without people realizing it. Loss aversion, for example, describes a tendency to fear losses more than valuing equal gains. This bias can lead to overly cautious strategies, like selling assets after a loss instead of waiting for potential recovery. Overconfidence is another common bias, often causing people to underestimate risks or believe their judgment is more accurate than it actually is. These mental shortcuts can hinder objective analysis and, if left unchecked, sustain poor financial habits.

Social Influences and Herd Behavior

Economic decision-making rarely happens in isolation. Social dynamics strongly shape how individuals perceive risks and opportunities. Herd behavior—where people instinctively follow the actions of a group—can be enormously influential in markets. This phenomenon is evident during speculative bubbles, when rational analysis is often ignored in favor of group consensus. Social media has only intensified herd mentality, enabling the rapid spread of accurate and misleading economic news. Awareness of group dynamics’ effects is essential for making independent, thoughtful financial choices.

Neuroeconomics: The Science of Decision-Making

Neuroeconomics bridges neuroscience, psychology, and economics to illuminate how people make decisions. Researchers have identified key regions in evaluating risks and rewards by examining the brain’s processes. For example, the amygdala processes emotions like fear, directly impacting investment decisions. The prefrontal cortex, on the other hand, governs rational analysis and long-term planning. Understanding this interplay has enabled new strategies to help people make more deliberate economic choices. This interdisciplinary field continues to uncover ways to counteract biases and promote improved financial health.

Media Influence on Economic Perceptions

The media wields considerable power over public perception of economic conditions. Sensationalized headlines can provoke fear or euphoria, sometimes with little basis. For instance, dramatic reports about looming recessions may prompt consumers to cut spending, setting off a chain reaction of reduced demand and slowed economic activity. Media and political messaging manipulation of economic feelings underscores the importance of media literacy. Readers should approach economic news critically, checking facts and diversifying the sources from which they obtain information.

Strategies for Improving Economic Decision-Making

Awareness of the psychological influences is only the first step toward better financial decision-making. Several strategies can reduce errors and increase rationality in economic choices:

Increase Financial Literacy

- Education about basic financial principles helps individuals recognize and counteract biases, resulting in more informed choices over time.

Recognize Emotional Triggers

- Being mindful of emotional states, such as excitement or anxiety, allows for pausing before making financial moves—often leading to clearer, more reasoned outcomes.

Diversify Information Sources

- Consulting multiple news outlets and expert perspectives helps counteract cognitive and media-generated biases.

Seek Professional Advice

- Financial planners and advisors provide guidance tailored to personal goals and risk profiles, helping to avoid impulsive, emotionally-driven decisions.

By harnessing knowledge of these psychological factors and applying proactive strategies, individuals and professionals alike can make more balanced, effective economic decisions—ultimately fostering greater financial health and resilience in uncertainty.