Planning your finances for the year goes beyond tracking bills, rent, or groceries. One area that often gets overlooked is health and wellness. While insurance might cover part of the cost, there are many medical and wellness expenses that still require your attention—and your wallet.

Whether it’s an annual physical, a therapy session, or a monthly prescription, these costs can add up quickly. If you’re not keeping track, it’s easy to be caught off guard by a surprise co-pay or to realize you’ve spent more than expected by year’s end.

Setting aside a budget for your health doesn’t mean expecting problems. It simply helps you be ready for the things that most people deal with at some point during the year. Knowing what to include in that budget is the first step, and this guide will walk you through the most common categories to consider.

Preventive Care and Routine Checkups

Preventive care is the foundation of a solid wellness plan. It’s easier—and cheaper—to catch problems early or avoid them altogether than to deal with them later. That’s why it’s smart to plan ahead for checkups, screenings, and routine tests, even if you feel healthy.

Annual physical exams are often covered by insurance, but additional services like blood work, skin checks, or hearing tests may involve extra costs. You’ll also want to include eye exams and vision care if they’re not part of your standard health coverage. These visits are easy to forget but are just as important in the long run.

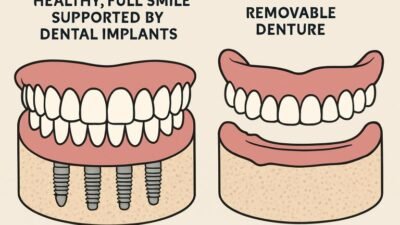

Dental care is another essential piece of preventive health. Cleanings, exams, and early treatment can help you avoid more serious—and more expensive—problems down the road. Many people also set aside funds for biannual cleanings or basic dental work with trusted providers like the Dental Team, which offers comprehensive care for individuals and families. Routine visits are simple to schedule, and being consistent with them helps maintain long-term oral health.

Even when some of these services are partly covered by a plan, there’s often a co-pay or balance that comes out of pocket. Budgeting for that ahead of time avoids surprises. For those without insurance, it’s even more important to plan. Look at the past year’s costs and use that as a baseline for what to expect in the future.

Preventive care isn’t a luxury—it’s a regular part of staying healthy. When you include it in your annual spending plan, you’re more likely to follow through on appointments, stay on top of your health, and avoid bigger problems later.

Prescription Costs and Medications

Prescription costs can make up a large portion of yearly health spending, even for people with insurance. If you take medication on a regular basis—like blood pressure pills, asthma inhalers, or antidepressants—it helps to review the average monthly cost and multiply it out for the full year.

Don’t forget seasonal or short-term needs. Antibiotics, allergy treatments, or cold remedies can sneak into your budget without much warning. Some may be covered by insurance, but others might come with a co-pay or full cost, depending on your plan.

Over-the-counter medications also add up. Products like pain relievers, antacids, allergy drops, or even multivitamins are part of wellness care. If you buy them often, it makes sense to track them and include them in your yearly estimate.

It helps to keep a list of what you typically use and where you buy it. Some pharmacies offer discounts, loyalty programs, or generic alternatives that lower your total cost over time. Planning for these expenses upfront can take the stress out of unexpected trips to the pharmacy.

Mental Health and Counselling Services

Mental health is just as important as physical health. More people are making space for it in their budget, and that’s a good thing. Whether it’s therapy, group counselling, or an app-based support tool, these services are becoming part of regular wellness routines.

Therapist visits can vary widely in cost. Some providers offer sliding-scale pricing based on income. Others may take insurance, but sessions may still include a co-pay. If you see a counsellor once or twice a month, that adds up over time. Setting aside a specific amount each month can help you stick to the schedule and get the support you need.

Mental health care might also include subscriptions to meditation apps, online therapy platforms, or stress management courses. Even if you don’t use these tools every week, having money set aside allows you to access them when you need them most.

You don’t have to be in a crisis to benefit from mental health care. Some people just need a space to talk things through, stay grounded, or manage daily stress. Having funds ready makes that choice easier when the time comes.

Health Products, Fitness, and Alternative Wellness

Wellness spending isn’t limited to doctors and prescriptions. Many people use health products and services that support their daily routines, physical activity, or recovery. That includes things like gym memberships, fitness classes, massage therapy, or physical therapy sessions.

You might also use products like foam rollers, posture supports, fitness trackers, or standing desk accessories. These aren’t medical tools, but they contribute to your overall well-being. If you replace your running shoes twice a year, that should be in your budget too.

Alternative care, like chiropractic visits or acupuncture, is also something to factor in if it’s part of your lifestyle. Even if it’s occasional, the cost can add up.

Wellness looks different for everyone. What matters is tracking what you actually use and seeing if it’s helping. If it improves how you feel, move, or rest, it deserves a spot in your annual plan.

Health and wellness costs are part of everyday life. Planning for them ahead of time gives you more freedom to make better decisions when they come up. You don’t have to predict every bill—just start with what you already know, and build from there. With a little awareness, your wellness budget can support both your health and your peace of mind all year long.